Losing your job is a stressful and uncertain time. Your income falls dramatically but everyday living costs and bills stay the same. The old Jobseekers Benefit helped but often left a significant shortfall.

In Fine Gael, we’ve always been focused on making work pay and ensuring that everyone who pays into the social welfare fund benefits from it, when needed.

That’s why we expanded access to supports, like Dental and Optical Benefits and Illness Benefit to self-employed people.

Now, we’re building on this progress by introducing a new Jobseekers Benefit that is linked to previous pay.

What’s new?

From now on, if you lose your job you can apply for Jobseeker’s Pay-Related Benefit.

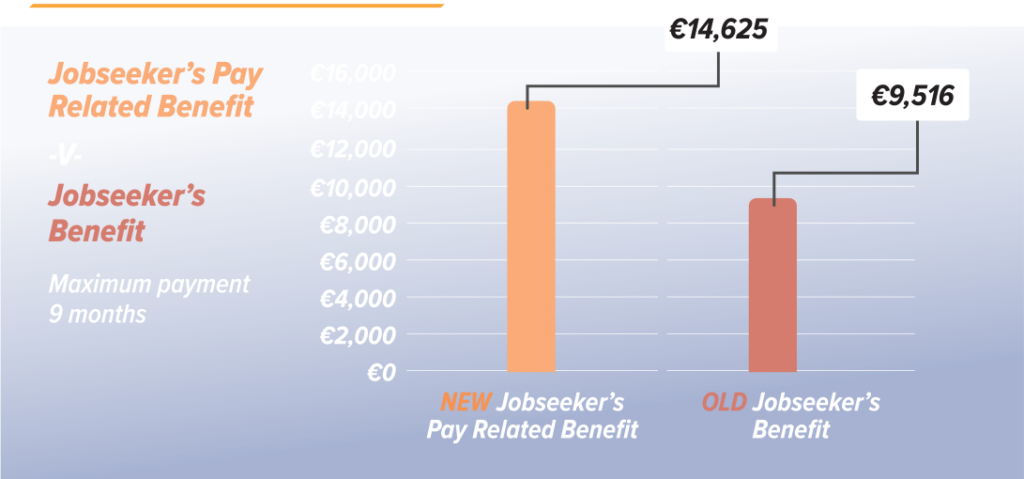

This will provide a weekly payment that is linked to your previous pay. In effect, it will increase the amount of support by more than 50% and will help you focus on finding a new job or to avail of short skills-based courses and training.

It means you can focus on getting back on your feet, safe in the knowledge that you will receive a higher weekly payment to help you meet essential bills, like rent or mortgage payments.

How is this different?

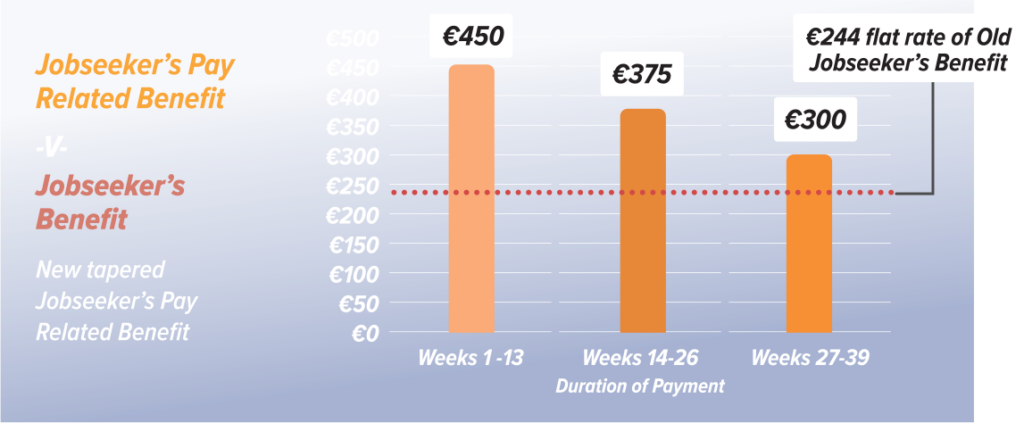

Until now, Jobseeker’s Benefit has been paid at a flat rate of €244 per week for a maximum of nine months (six months for people in the workplace for fewer than five years). For most people, this rate of payment left a significant gap between their income and their outgoings.

Now, payments will be linked to previous pay and will be paid on a tapered basis. The payment will be calculated as a percentage of previous gross weekly earnings up to a maximum of €450 per week.

What’s the rate of payment?

The rate of payment depends on your previous weekly pay (gross). It ranges from a minimum payment of €125 per week to a maximum payment of €450 per week. Any person who had been earning the average wage in Ireland would qualify for the top rate.

Jobseeker’s Pay-Related Benefit

| Duration | Amount |

|---|---|

| First 3 months (Week 1 to Week 13) | 60% of previous weekly pay or €450 maximum |

| Second 3 months (Week 14 to Week 26) | 55% of previous weekly pay or €375 maximum |

| Third 3 months (Week 27 to Week 39) | 50% of previous weekly pay or €300 maximum |

What’s the rate of payment if I have fewer PRSI contributions?

If you have between 104 and 259 PRSI contributions, you will be eligible for JPRB payment of 50% of your previous weekly pay up to a maximum of €300 per week. You will receive a minimum payment of €125.

How do I qualify?

As with all social welfare benefits, qualifying for the new Jobseeker’s Pay-Related Benefit is based on your PRSI contributions – sometimes called ‘stamps’ – you make each week. Most workers pay the ‘A’ class contribution.

You’ll be eligible for Jobseeker’s Pay-Related Benefit if:

How long will I receive

Jobseeker’s Pay-Related Benefit?

| PRSI Contributions | Duration |

|---|---|

| 260 or more (At work for five years or more) | Nine months |

| Between 104 to 260 (Two to five years at work) | Six months |

After this, if you have not secured a new job or returned to education, you may apply for Jobseeker’s Allowance, which is means-tested.

How do I apply?

If you have lost your job, you can apply for JPRB online at www.mywelfare.ie or by visiting your local Intreo Office or Social Welfare Local Office.